Introduction to Trading

Trading is a fundamental financial activity that involves the buying and selling of various assets with the aim of making a profit. In essence, it is a mechanism by which individuals, institutions, and even governments engage in the exchange of financial instruments, bridging the gap between buyers and sellers in the financial markets. The significance of trading is underscored by its diverse forms, which cater to different preferences, risk appetites, and expertise levels.

One of the most common forms of trading is stock trading, where investors purchase shares of publicly listed companies. This type of trading operates on stock exchanges, with prices determined by supply and demand dynamics. Another prevalent form is forex trading, which involves the exchange of currencies in a global market that is open 24 hours a day. Forex trading not only allows for substantial liquidity but also provides opportunities for arbitrage due to price fluctuations that occur across different markets.

Additionally, commodities trading involves the buying and selling of physical goods, such as gold, oil, or agricultural products. This market is influenced by global events, weather patterns, and economic indicators, presenting unique trading opportunities. Lastly, the rise of technology has paved the way for cryptocurrency trading, enabling participants to trade digital assets such as Bitcoin and Ethereum. This evolving market offers high volatility, creating potential for significant profits but also considerable risks.

Understanding these various forms of trading is crucial for individuals looking to explore the financial landscape. With the right knowledge and tools, trading becomes not just a method of investment, but also a gateway to unlocking numerous financial opportunities. As we delve deeper into the advantages of trading, both novices and seasoned traders can benefit from recognizing the potential that trading holds within the financial markets.

Financial Independence and Wealth Building

Trading provides individuals with an opportunity to pursue financial independence and build wealth through various strategies. By participating in the financial markets, traders can capitalize on capital appreciation, benefiting from the increase in asset values over time. This appreciation can be realized through active trading or long-term investments, allowing traders to grow their portfolios significantly.

In addition to capital gains, trading can also generate income through dividends, which are payments made by companies to their shareholders. For investors focused on generating a steady income stream, dividend-paying stocks can be a reliable source of passive income. This aspect of trading enhances the likelihood of achieving financial security, as it allows traders to reinvest their earnings or utilize them for living expenses.

Moreover, leveraging investments is a strategy often employed in trading to amplify potential returns. By borrowing funds to increase the size of investments, traders can significantly boost their profits. However, it is crucial to approach leverage with caution due to the inherent risks involved. If the market moves against a leveraged position, it can lead to substantial losses, making risk management an essential component of successful trading.

Risk management techniques, such as setting stop-loss orders and diversifying investment portfolios, are vital in preserving capital and achieving long-term financial goals. By systematically managing risk, traders can create sustainable income streams while pursuing their wealth-building objectives.

Through disciplined trading, individuals can harness financial markets to achieve financial independence, providing the freedom to make lifestyle choices that align with their aspirations. The potential for wealth accumulation is significant, and with careful strategy and risk management, trading can be a viable pathway to a more financially secure future.

Flexibility and Accessibility of Trading

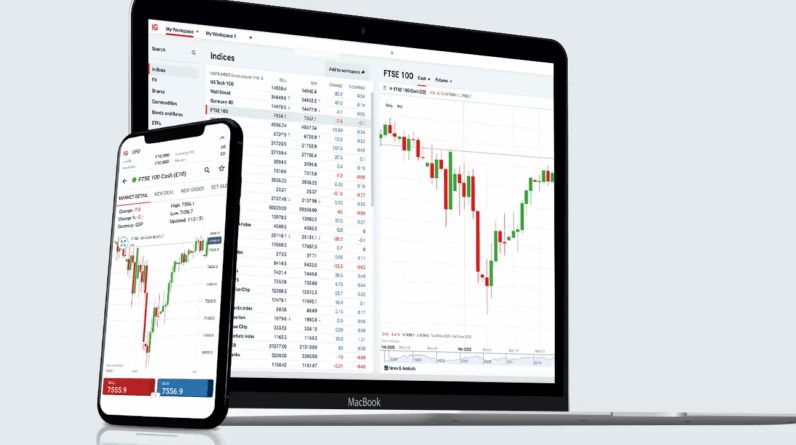

Trading has emerged as a highly flexible investment vehicle that offers individuals unparalleled accessibility. One of the most significant advantages of trading is the ability to engage in financial markets from virtually anywhere in the world, provided there is internet access. This has transformed the landscape of investing, enabling traders to operate from their homes, offices, or even while traveling. The convenience of modern technology allows individuals to monitor their trades and market movements using smartphones and laptops, thus facilitating informed decision-making on-the-go.

Moreover, the proliferation of various trading platforms has further enhanced this accessibility. Many platforms are now user-friendly, catering to both novice and experienced traders. This democratization of trading means that individuals have access to a wealth of resources, including educational materials, real-time data, and analytical tools that empower them to make informed trades. These platforms often provide a range of products to trade, from stocks and commodities to forex and cryptocurrencies, allowing traders to diversify their portfolios according to their preferences and risk tolerances.

Another pertinent aspect of trading is the flexibility with which it can be conducted. Unlike traditional investment avenues that may require a significant time commitment, trading allows individuals to operate on their own schedules. Whether someone wishes to trade full-time or just during their spare time, the flexibility inherent in trading accommodates various lifestyles and commitments. Additionally, the relatively low barriers to entry make it an appealing choice; many trading platforms require only a modest initial investment to begin trading. As such, individuals from diverse financial backgrounds can participate in trading, unlocking numerous financial opportunities that may not be available through other investment channels. The culmination of these elements positions trading as a versatile and accessible option for aspiring investors.

Educational Growth and Personal Development

Trading provides a unique platform for individuals to foster educational growth and personal development. Engaging in trading activities cultivates essential skills that are pivotal in both financial and personal realms. One of the primary skills developed through trading is analytical thinking. Successful traders must analyze vast amounts of data, identifying patterns and potential market movements. This analytical aptitude not only aids in making informed trading decisions but also enhances problem-solving capabilities applicable in various aspects of life.

Furthermore, trading necessitates decision-making under pressure. Market conditions are often volatile, requiring individuals to make swift decisions that can significantly impact their financial outcomes. This experience strengthens one’s ability to handle stress, sharpen intuition, and prioritize tasks efficiently. Thus, individuals learn to maintain composure in high-pressure situations, a skill valuable in both professional and personal contexts.

Emotional resilience is another crucial trait honed through trading. Traders inevitably encounter losses and setbacks, which can evoke strong emotional responses. Learning to navigate these emotions, such as fear and greed, instills a sense of discipline and patience. It encourages individuals to adopt a growth mindset, viewing challenges as opportunities for self-improvement rather than insurmountable obstacles.

Moreover, the landscape of trading is dynamic, underscoring the significance of continuous learning. Staying abreast of market trends and developments is essential for success. Engaging with different trading strategies enhances one’s financial literacy, allowing one to explore diversified approaches tailored to individual risk tolerance and investment goals. The journey of becoming a proficient trader is marked by ongoing education, encouraging a proactive stance towards knowledge acquisition and self-enhancement.

Ultimately, the educational growth and personal development gleaned from trading transcend financial profitability, making it a transformative experience for individuals willing to invest time and effort into honing these invaluable skills.