Understanding the Basics of Trading

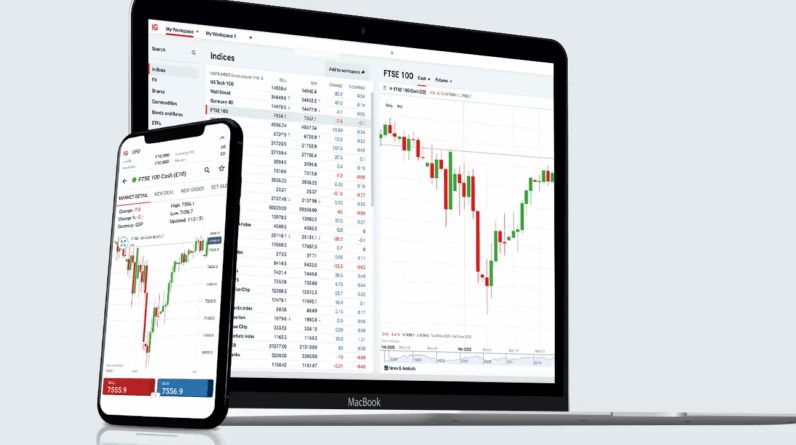

Trading is the process of buying and selling financial assets with the intent of making a profit. At its core, trading takes place within various financial markets, each offering distinct opportunities and challenges. Understanding these markets is essential for any aspiring trader. There are several types of trading strategies one can adopt, including day trading, swing trading, and long-term investing. Day trading involves executing numerous trades throughout the day, capitalizing on small price movements, while swing trading targets short- to medium-term trends over days or weeks. Long-term investing, on the other hand, focuses on a buy-and-hold strategy, allowing investors to benefit from the gradual appreciation of assets over time.

Familiarity with key trading terminology is crucial when entering the world of trading. Terms such as ‘bull market,’ ‘bear market,’ ‘volatility,’ and ‘liquidity’ form the bedrock of trading discourse. A comprehensive understanding of these concepts can help mitigate the risks associated with trading. Furthermore, the significance of market mechanics cannot be overstated. Grasping how orders are executed, the role of market makers, and the impact of news on market prices creates a foundation for effective trading.

Additionally, various asset classes, including stocks, forex, and cryptocurrencies, cater to different trading preferences. Stocks represent ownership in a company, while forex trading involves exchanging currencies based on their relative values. Cryptocurrencies, on the other hand, offer a decentralized alternative to traditional currencies, enabling innovative trading strategies. Effective market analysis is vital for making informed trading decisions. Utilizing fundamental analysis, which evaluates economic indicators and company performance, alongside technical analysis, which assesses price patterns and market trends, can better position traders for success. By integrating these elements, individuals can navigate the complexities of trading with increased confidence and understanding.

The Importance of Developing a Trading Plan

A trading plan is an essential framework that guides traders in making informed decisions, ultimately leading to improved trading success. The critical role of a trading plan cannot be overstated, as it establishes clear goals, dictates strategies, and controls emotional responses during volatile market situations. One of the first steps in crafting an effective trading plan is setting specific and measurable objectives. These goals should align with individual trading styles and risk tolerance levels, providing a targeted approach to trading.

Risk management strategies must also be integral to any trading plan. Successful traders understand the potential for loss and utilize various techniques to mitigate risks. This can include setting stop-loss orders and determining position sizing based on account balance and risk appetite. By incorporating these strategies into their trading plans, traders can manage their capital more effectively and reduce the likelihood of emotionally driven decisions.

Maintaining discipline is another vital component of a successful trading plan. Traders often face temptations to deviate from their established strategies due to market fluctuations or emotional reactions. A well-defined trading plan serves as a reminder of the trader’s objectives and strategies, promoting consistency in decision-making. Furthermore, backtesting and refining trading strategies help traders adapt to changing market conditions, enhancing their overall performance. Backtesting involves applying a trading strategy to historical data to evaluate its effectiveness, allowing traders to make adjustments based on empirical evidence.

To create a personalized trading plan, traders should consider their experience levels, available time for trading, and individual preferences. Strategies may need to be adjusted periodically, ensuring they remain effective in the face of evolving market dynamics. By developing a comprehensive trading plan that encompasses these elements, traders can enhance their readiness for various market scenarios and bolster their potential for long-term success.

Recognizing the Right Time to Start Trading

Determining the optimal moment to begin trading can significantly influence an individual’s success in financial markets. Various elements must be taken into account, including prevailing market conditions, personal financial stability, and psychological readiness. Recognizing these factors is essential for determining one’s readiness in the trading environment.

Firstly, the overall market conditions play a pivotal role in assessing the right time to enter the trading arena. A bull market, characterized by rising prices and investor optimism, can offer a conducive environment for new traders. Conversely, a bear market—marked by declining prices—might not be the best entry point for beginners. Aspiring traders should keep abreast of market trends, economic indicators, and geopolitical factors that could influence market behavior.

Additionally, an individual’s personal financial situation is a critical aspect of readiness to start trading. It’s essential to have a solid financial foundation, including an emergency fund and minimal debt. Trading should not impede one’s ability to meet financial obligations. Adequate capital allows traders to withstand potential losses while gaining valuable experience.

Moreover, psychological readiness is equally important. Trading can evoke a range of emotions, including fear, greed, and impatience. An understanding of personal strengths and weaknesses in managing these emotions is vital. Traders should cultivate a mindset that embraces risk and accepts that losses are part of the journey.

Ultimately, individuals should assess their knowledge and experience levels. A comprehensive understanding of trading strategies and market behavior is crucial for making informed decisions. Personal confidence can serve as a good indicator that it might be time to embark on a trading journey. By contemplating these factors, potential traders can ensure they are better equipped to navigate the complexities of trading successfully.

Continuous Learning and Adaptation in Trading

Trading is an ever-evolving landscape, where continuous learning and adaptation are pivotal for success. A trader who remains stagnant in their knowledge and strategies is unlikely to thrive in dynamic market conditions. The importance of ongoing education cannot be overstated; traders must familiarize themselves with new tactics, technologies, and analytical tools. A plethora of resources is available for traders seeking to enhance their skills, including online courses, webinars, and interactive trading communities.

Online courses can provide structured learning environments where traders can delve deep into specific topics such as technical analysis, trading psychology, or risk management. Many reputable institutions offer these courses, often tailored to different levels of experience. Webinars, on the other hand, provide opportunities to engage with industry experts who share real-time insights into current market trends and potential strategies, allowing participants to gain invaluable knowledge at their convenience.

Participation in trading communities can further enrich the learning experience. These forums facilitate discussions among traders of all skill levels, enabling individuals to share experiences, strategies, and advice. It is crucial, however, for traders to conduct self-assessments regularly. Reflecting upon past trades—both successful and unsuccessful—fosters deeper learning, helping traders to understand their strengths and weaknesses.

Additionally, being attuned to market trends, economic indicators, and global news events is essential. These factors can significantly influence trading decisions, making it imperative for traders to remain informed. Moreover, possessing an adaptable mindset and flexibility in strategies is vital for long-term success. As markets change, traders should be prepared to adjust their approaches accordingly, maintaining an open mind to new possibilities. This dedication to continuous learning and adaptation ultimately lays the foundation for a successful trading career.