Understanding the Basics of Trading

Trading refers to the process of buying and selling financial instruments, such as stocks, currencies, and commodities, with the aim of generating profits. It operates within various markets, each characterized by its unique properties and dynamics. Some of the most common markets include the stock market, foreign exchange (forex) market, and cryptocurrency market.

The stock market is where shares of publicly traded companies are bought and sold. Investors purchase stocks in hopes that their value will increase over time, allowing them to sell at a profit. The forex market, on the other hand, involves trading national currencies. As the value of one currency rises or falls in relation to another, traders can profit from these fluctuations. Lastly, the cryptocurrency market has gained popularity in recent years, featuring digital currencies like Bitcoin and Ethereum, which operate on decentralized platforms.

To navigate these markets effectively, one must be familiar with key trading terminologies. For instance, “bull market” refers to a market experiencing a sustained increase in prices, while a “bear market” denotes a declining market. Understanding other concepts such as “liquidity,” which highlights the ease of selling an asset without affecting its price, is also essential.

Moreover, grasping market dynamics is crucial for successful trading. Market dynamics include factors such as supply and demand, which underlie price movements. Economic indicators—such as GDP growth rates, employment figures, and inflation levels—also play a significant role in influencing market trends. By analyzing these indicators, traders can make informed decisions, enhancing their potential to capitalize on market movements.

Ultimately, a strong foundation in the fundamentals of trading is vital for anyone looking to enter the realm of financial markets. Familiarity with different types of markets, key terminologies, and the elements that drive market behavior will set beginners on the path toward informed trading decisions.

Choosing the Right Market for You

When embarking on a trading journey, it is crucial to choose a market that aligns with your interests, risk tolerance, and investment goals. Various trading markets exist, each offering distinct characteristics that can influence your trading strategy. Understanding these markets will enable you to make a more informed decision.

One of the primary considerations when selecting a trading market is volatility. Volatile markets, such as cryptocurrencies, can provide substantial opportunities for profit due to their rapid price movements. However, they also entail a higher risk, making them suitable primarily for those who are comfortable with significant fluctuations. Conversely, more stable markets, like bonds or certain equities, typically exhibit less volatility, which may appeal to conservative investors seeking steady returns.

Another factor to consider is liquidity, which refers to how quickly assets can be bought or sold without impacting their price. Highly liquid markets, such as the foreign exchange (Forex) market, offer ease of entry and exit, allowing traders to execute large trades with minimal slippage. Alternatively, illiquid markets can lead to difficulties in executing trades swiftly and might expose traders to larger price swings. It’s essential to evaluate your investment strategy and choose a market that provides the liquidity level you require.

Trading hours also play a significant role in your selection process. Different markets operate at varying hours, which may affect your ability to trade based on your personal schedule. For instance, the stock market typically functions during specific daytime hours, while Forex operates virtually 24 hours a day. Choosing a market that aligns with your availability can help ensure that you remain engaged and informed about your trades.

Ultimately, by assessing volatility, liquidity, and trading hours, you can identify the market that best fits your trading strategy. Understanding these elements will empower you to make choices that align with your overall investment objectives.

Setting Up Your Trading Account

Establishing a trading account is a fundamental step for anyone looking to engage in trading activities. The first decision a novice trader faces is the selection of a broker. A broker serves as an intermediary between the trader and the market, making it crucial to choose one that aligns with your trading needs and preferences. Factors such as brokerage fees, account types, platform features, and regulatory compliance should be thoroughly evaluated.

Brokerage fees can significantly impact profitability, especially for those who intend to trade frequently. Fees may include commissions on trades, account maintenance fees, and withdrawal charges. It is advisable to compare the fee structures of multiple brokers to find the most cost-effective solution that meets your trading volume and style. Additionally, some brokers offer commission-free trading, but they may have other avenues for generating revenue, such as wider spreads.

Different account types are available to traders, ranging from standard accounts to more specialized options like mini or micro accounts, which require lower initial deposits. It is important to assess how much capital you are willing to invest, as this will influence your choice of account type. Furthermore, some brokers offer access to varying asset classes such as stocks, forex, commodities, and cryptocurrencies, which could affect the diversification of your portfolio.

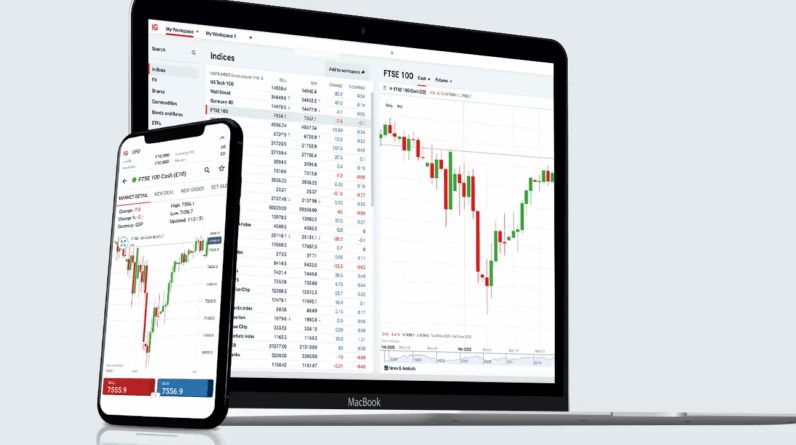

The trading platform offered by the broker is another critical aspect to consider. A user-friendly platform with robust analytical tools can enhance your trading experience. Ensure that the broker’s platform supports mobile trading, if necessary, allowing you to monitor the markets and make trades on the go. Lastly, confirming that the broker is regulated by a recognized authority can provide peace of mind, ensuring that your funds are managed securely.

In summary, setting up your trading account involves careful consideration of various factors, including brokerage fees, available account types, platform features, and regulatory oversight. Selecting the right broker is essential for a successful trading journey.

Developing a Trading Plan

Establishing a well-structured trading plan is crucial for anyone looking to navigate the complexities of the trading world. A trading plan serves as a roadmap, guiding traders in their decision-making processes while helping them manage their capital effectively. The first step in creating a robust trading plan is to set clear trading goals. These objectives can range from short-term profit targets to long-term investment strategies, depending on individual preferences and risk tolerance. By having specific goals in place, traders can better assess their performance and stay motivated during challenging periods.

Next, risk management strategies play an essential role in safeguarding a trader’s capital. Identifying acceptable risk levels is vital; this may include determining the maximum amount of capital to risk on a single trade or establishing stop-loss orders to minimize potential losses. A disciplined approach to risk management ensures that traders do not deviate from their trading plan, even in the face of emotional decision-making stemming from market fluctuations.

Equally important are the entry and exit points, which should be defined based on thorough market analysis. Traders can utilize various technical indicators and fundamental analysis to identify ideal conditions for entering trades. Additionally, outlining specific exit strategies, such as taking profits at predetermined levels or adjusting stop-loss orders, can significantly enhance a trader’s ability to respond to changing market conditions. By integrating these elements into a comprehensive trading plan, traders can systematically approach their trading activities, reducing impulsive decisions and enhancing overall performance.

In conclusion, developing a structured trading plan is an integral part of successful trading. By clearly defining trading goals, employing effective risk management strategies, and establishing precise entry and exit points, traders can create a framework that promotes disciplined and systematic trading practices.

Learning Technical and Fundamental Analysis

In the realm of trading, two predominant approaches serve as the backbone for decision-making: technical analysis and fundamental analysis. Understanding the distinction between these two methodologies is essential for beginners who seek to navigate the complexities of the financial markets effectively.

Technical analysis primarily involves the study of price movements and patterns on charts. Traders utilizing this approach focus on historical price data, employing various tools such as trend lines, candlestick patterns, and moving averages. Indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are commonly utilized to identify potential entry and exit points. The underlying premise is that historical price movements can forecast future market behavior, allowing traders to make informed predictions about short-term price action.

Conversely, fundamental analysis centers around assessing the intrinsic value of an asset based on macroeconomic factors, industry trends, and financial statements. This analysis seeks to evaluate the underlying conditions that might affect the price of a stock or currency. Economic indicators, including GDP growth rates, unemployment figures, and inflation rates, play a crucial role in this methodology. By understanding the broader economic landscape and the health of the company or asset in question, traders can gauge potential long-term appreciation or depreciation.

Both technical and fundamental analysis have their unique strengths. While technical analysis provides valuable insights into market sentiment and timing, fundamental analysis offers a broader view of the economic forces at play. A thorough understanding of both approaches can thus enable traders to enhance their market predictions, leading to more strategic trading decisions. As you embark on your trading journey, consider integrating elements of both technical and fundamental analysis to build a well-rounded strategy capable of adapting to shifting market conditions.

Starting with a Demo Account

For those newly venturing into the world of trading, utilizing a demo account is a prudent first step. A demo account serves as a simulated trading environment, allowing beginners to practice without the financial risk associated with actual trading. This method provides the opportunity to explore various trading strategies and familiarize oneself with the chosen trading platform.

One of the primary benefits of engaging with a demo account is the ability to test multiple strategies without the worry of losing real money. Traders can experiment with different approaches, gauge their potential effectiveness, and refine their techniques. Such experimentation is crucial, as it builds confidence and enhances decision-making skills when it comes time to transition to a live trading scenario. It becomes easier to identify which strategies align with personal risk tolerance and trading goals.

Moreover, a demo account helps familiarize users with the trading platform’s functionalities. Each platform has its unique features that may be daunting for beginners. By practicing on a demo account, newcomers can learn how to execute trades, analyze charts, and utilize various tools available for effective trading. This hands-on experience is invaluable and contributes to a smoother transition to actual trading.

Furthermore, using a demo account can help you understand market conditions and how they may impact your trading decisions. Getting a grasp of the behavioral patterns of different trading instruments can be achieved through daily practice without real consequences. This informed perspective is essential when real capital is on the line, where emotional elements come into play.

In conclusion, taking advantage of a demo account is a strategic move for any beginner looking to start trading. It provides a risk-free environment to learn, practice, and prepare adequately for the challenges of live trading. By increasingly familiarizing oneself with trading strategies and platforms, traders enhance their skills, paving the way for a more successful trading experience in the future.

Executing Your First Trade

When embarking on your trading journey, executing your first trade can be a pivotal moment. It is essential to understand the steps involved in placing a trade, managing orders, and effectively monitoring market movements to ensure a smooth experience. To begin, choose a reputable trading platform that suits your needs. Most platforms offer user-friendly interfaces along with comprehensive tutorials to guide you through the process.

Once you have selected a platform and established your account, you’ll want to navigate to the trading section. Here, you can search for the asset you wish to trade, such as stocks, currencies, or commodities. After selecting your asset, you will encounter options for placing a buy or sell order. Depending on your market analysis, decide whether you want to enter a long position (buy) or short position (sell).

To safeguard your investment, familiarize yourself with managing orders like stop-loss and take-profit. A stop-loss order allows you to set a predetermined price at which your position will be automatically sold to limit potential losses. Conversely, a take-profit order ensures that your trade exits automatically when a certain profit level is reached. Properly employing these tools can enhance your trading strategy, offering a structured approach to managing risk.

Once your trade is executed, it is crucial to monitor market movements actively. This means regularly checking the performance of your asset and staying informed about market news that could influence its price. Utilizing technical analysis tools and chart patterns can also provide invaluable insights into market trends. Engaging with trading communities can further enhance your understanding and provide support as you develop your skills.

By following these foundational steps, beginners can gain confidence in executing trades and develop their trading strategies over time, setting the stage for further success in the trading realm.

Continuously Educating Yourself

In the ever-evolving landscape of trading, continuous education is paramount to achieving success. The financial markets are dynamic, presenting traders with new challenges and opportunities. For this reason, ongoing learning not only helps traders refine their skills but also allows them to adapt swiftly to market changes. Engaging in continuous education provides traders with valuable insights and strategies that can significantly enhance their decision-making processes.

There are numerous resources available for traders seeking to educate themselves. Books authored by seasoned traders and financial experts offer in-depth knowledge about trading theories, methodologies, and real-world applications. Titles like “Market Wizards” by Jack D. Schwager or “The Intelligent Investor” by Benjamin Graham are excellent starting points. These resources can empower traders with foundational knowledge and inspire them to pursue their unique trading strategies.

Furthermore, online courses and webinars have become increasingly popular for those who prefer structured learning formats. Websites such as Coursera, Udemy, and Investopedia offer a plethora of courses ranging from basic trading principles to advanced technical analysis. Participating in these learning formats creates an engaging environment where traders can interact with instructors and peers while gaining insights into market trends and trading techniques.

Another crucial aspect of continuous education is the role of trading communities. Engaging with fellow traders through forums, social media groups, or live trading rooms can provide support and a platform for exchanging ideas. These communities enable traders to share experiences, discuss strategies, and develop a deeper understanding of market dynamics collectively. Integrating regular education into one’s trading routine is essential, whether through dedicated reading time, completing online courses, or participating in community discussions. This commitment to learning ensures that traders remain well-informed and equipped to navigate the complexities of the financial markets.

Maintaining a Trading Journal

A trading journal serves as an invaluable tool for both novice and experienced traders alike. This systematic documentation provides a structured approach to tracking trades, analyzing strategies, and managing emotional responses during trading activities. By consistently maintaining a trading journal, traders can cultivate a deeper understanding of their trading patterns, ultimately improving performance over time.

One of the key benefits of keeping a trading journal is the ability to monitor each trade’s specifics, including entry and exit points, position sizes, and the rationale behind each decision. Recording these details allows traders to identify successful strategies and patterns that have yielded positive results in the past. Over time, this information will support the development of a more refined trading strategy, tailored to individual preferences and risk tolerance.

Moreover, a trading journal encourages accountability. By documenting every trade and its associated emotions, traders can reflect on their decision-making processes. This introspection helps mitigate impulsive trading behaviors driven by fear or greed. A trader who is aware of their emotional responses is better equipped to manage them, fostering disciplined trading practices that are essential for long-term success.

In addition to tracking trades and emotions, a trading journal also serves as a platform for setting goals. Traders can outline their targets, both in terms of financial outcomes and skill development, creating a roadmap for their trading journey. This focus on personal growth encourages continuous learning and adaptation, ensuring traders remain engaged in their trading endeavors.

In conclusion, maintaining a trading journal is a vital habit for anyone looking to enhance their trading skills. By thoroughly documenting trades, evaluating strategies, and recognizing emotional triggers, traders can build a foundation for accountability and informed decision-making, paving the way for improved trading performance in the future.