Understanding Trading: An Overview

Trading is the act of buying and selling financial instruments, which can include stocks, bonds, commodities, currencies, and derivatives. This fundamental exchange occurs in various markets, primarily organized into stock exchanges and over-the-counter (OTC) markets. At its core, trading allows participants to profit from the fluctuations in the price of these instruments, contributing to market liquidity and price discovery.

The ecosystem of trading includes a diverse array of participants. Individual investors, institutional investors, hedge funds, and market makers all play significant roles in this environment. Individual investors, often referred to as retail traders, primarily engage in trading for personal wealth accumulation. Institutional investors, such as pension funds and mutual funds, manage large sums of money and typically influence market trends due to their vast buying or selling power. Market makers facilitate transactions by providing liquidity and ensuring that trades can be executed without undue delay, thus stabilizing the market.

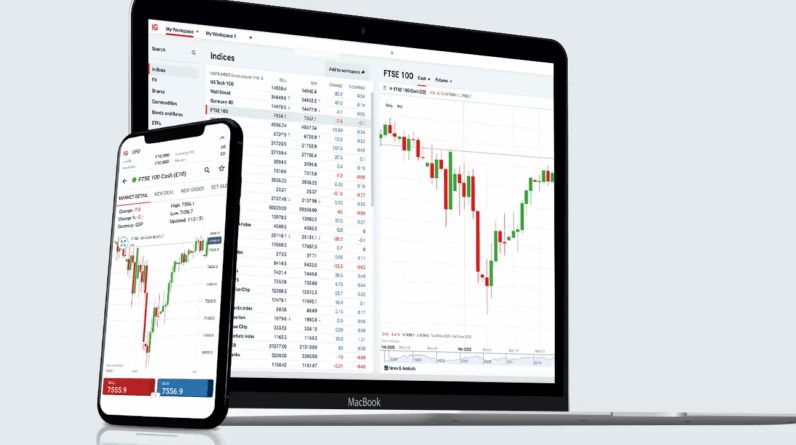

Brokers are vital intermediaries in the trading process. They connect buyers and sellers, providing access to the markets and offering various services, including research, advice, and trading platforms. The evolution of technology has enhanced the role of brokers, with many now offering online platforms that allow for algorithmic and high-frequency trading. This accessibility has democratized trading, enabling a broader range of individuals to participate in financial markets.

The importance of trading in the global economy cannot be overstated. It enables the circulation of capital, aids in price setting, and supports overall economic stability. Trading activities lead to the efficient allocation of resources, fostering economic growth and development. Furthermore, the ability for individual investors to engage in trading represents a path to wealth creation, allowing them to harness the potential of financial markets for personal benefit.

Types of Trading: Day Trading, Swing Trading, and Position Trading

Trading markets present various strategies for individuals to engage with financial instruments. Among these, day trading, swing trading, and position trading stand out as prominent methods, each characterized by distinct time frames, techniques, and psychological demands.

Day trading involves executing multiple trades within a single day, capitalizing on small price fluctuations. Traders using this strategy often rely on technical analysis and real-time market data to make rapid decisions. The primary advantage of day trading is the potential for high returns in a short amount of time. However, it demands a significant commitment, as traders must monitor markets continuously throughout the day, which can lead to heightened stress levels and emotional fatigue.

Swing trading, in contrast, adopts a longer time frame, typically ranging from a few days to several weeks. This strategy aims to capture price movement or “swings” in the market. Swing traders analyze chart patterns and rely on both technical and fundamental analysis to identify lucrative entry and exit points. The key benefit of swing trading is the reduced time commitment compared to day trading, allowing traders to maintain their primary jobs while engaging actively in the markets. Nevertheless, it may expose traders to overnight risks and market volatility during off-hours.

Position trading represents the most extended approach, where trades may last from several weeks to months or even years. This strategy focuses on long-term market trends rather than short-term fluctuation, making it suitable for traders who prefer a patient, more analytical method. Position traders usually conduct in-depth research and depend less on day-to-day market movements. While this type of trading can provide substantial returns in the long run, it requires a considerable level of patience and a robust risk management strategy to withstand market downturns.

Ultimately, the choice between day trading, swing trading, and position trading depends on individual risk tolerance, time commitment, and trading goals. Each strategy offers unique advantages and challenges, making it essential for traders to carefully assess which aligns best with their financial objectives and lifestyle.

Specialized Trading Strategies

In the realm of trading, specialized strategies such as options, futures, and forex trading have gained significant traction among investors seeking to diversify their portfolios and increase potential returns. Each of these markets operates under distinct principles and presents unique instruments, risks, and rewards. Understanding these strategies is essential for traders looking to navigate the complexities of today’s financial landscape.

Options trading involves the buying and selling of contracts that grant the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. This form of trading allows investors to leverage potential price fluctuations while limiting their risk to the premium paid for the option. However, the intricacies of options pricing and expiration can present challenges, making it more suitable for experienced traders who can effectively manage these factors.

Futures trading, on the other hand, entails entering into agreements to buy or sell an asset at a predetermined price on a specified future date. This market is commonly associated with commodities but has expanded to include financial instruments such as indices, currencies, and more. Futures traders can hedge against price movements or speculate on future price trends. While the leverage offered in futures trading can amplify potential profits, it also increases exposure to substantial losses, necessitating a robust risk management strategy.

Lastly, forex trading, or foreign exchange trading, is where currencies are bought and sold against one another in an ever-fluctuating market. As the largest and most liquid market globally, forex trading offers opportunities for profit through margin trading and high leverage. However, it also requires traders to have a comprehensive understanding of geopolitical factors, economic indicators, and technical analysis. Participants in this market range from large institutions and hedge funds to individual day traders.

Each of these trading strategies requires a careful study of market behavior and a commitment to ongoing education. By diving into specialized trading approaches like options, futures, and forex, investors can expand their horizons and enhance their trading expertise.

Choosing the Right Trading Style for You

Selecting the most suitable trading style is a crucial step for anyone venturing into the world of trading. To begin this process, consider your individual needs, risk appetite, and lifestyle. A self-assessment is essential to gauge your comfort level with risk, the time you can dedicate to trading, and your financial goals. Ask yourself questions such as: How much capital are you willing to invest? What is your risk tolerance level? How much time do you wish to spend analyzing the markets and executing trades? These questions will help define whether you might prefer day trading, swing trading, or long-term investing.

Education plays a significant role in choosing a trading style. Understanding market dynamics, trading strategies, and technical analysis will empower you to make informed decisions. Numerous resources are available, ranging from books and online courses to webinars and trading forums. These materials not only enhance your knowledge but also provide practical insights into different trading styles and techniques used by experienced traders.

Moreover, practice is vital in developing your trading proficiency. Start with a demo account to simulate real trading conditions without financial risk. This step allows you to experiment with various strategies, test your emotional responses to market fluctuations, and refine your approach. Once you gain confidence, you can proceed to craft a personalized trading plan that aligns with your assessment and learnings.

In conjunction with your trading plan, consider following reputable trading blogs and joining communities of traders. These platforms often offer valuable support, mentorship opportunities, and shared experiences that can help you navigate your trading journey. Continuously engage in your trading education to adapt to the ever-changing market landscapes effectively. Overall, a thoughtful combination of self-reflection, education, and practice will guide you to select a trading style that best suits your needs and aspirations.