Introduction to Trading Apps

Trading apps have emerged as a pivotal tool for modern investors, facilitating transactions in a user-friendly digital environment. These mobile applications are designed to provide an integrated platform where individuals can buy and sell stocks, options, and other financial instruments with ease. The primary purpose of trading apps is to democratize access to financial markets, enabling not only seasoned traders but also everyday investors to participate actively in trading activities.

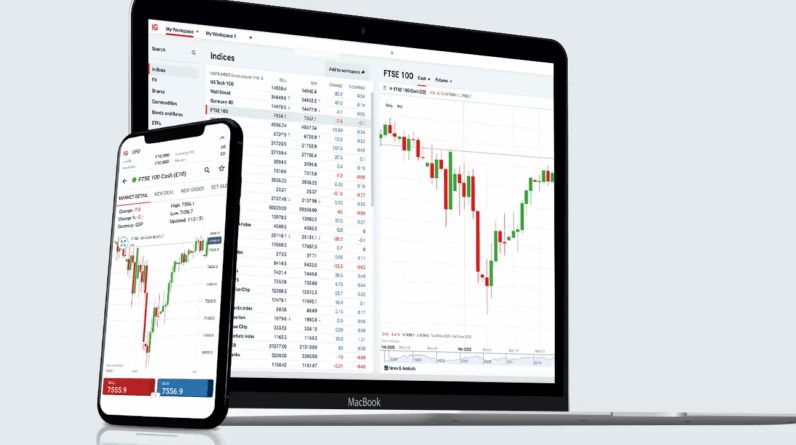

The functionality of trading apps has evolved significantly with advancements in technology. Initially, trading required a broker to process transactions, often resulting in high fees and limited access to market data. However, the rise of trading apps has shifted this paradigm, allowing users to execute trades directly from their smartphones or tablets. Features such as real-time market data, portfolio tracking, and financial analytics are now commonplace, enhancing the trading experience. Furthermore, push notifications and educational resources integrated into these apps empower users to make informed decisions quickly.

The growing popularity of trading apps can be attributed to multiple factors. The technological advancements have led to the development of more sophisticated and secure applications. Additionally, the rise of commission-free trading models has greatly lowered barriers to entry, attracting a wider audience. Social media and online forums have further fueled interest in investing, making trading more accessible to novice investors. Today, millions of users engage in trading through apps, resulting in a shift in the traditional investing landscape. As more individuals explore these platforms, the financial industry continues to adapt, reinforcing the significance of trading apps in the economy.

Features to Look for in Trading Apps

When selecting a trading app, several essential features should be taken into consideration to enhance the overall trading experience. The first aspect to evaluate is the user interface design. A well-designed app promotes ease of navigation, allowing traders to access their accounts, trading tools, and market analysis quickly. Cluttered interfaces can lead to confusion and potential trading errors, making simplicity and clarity pivotal for effective trading.

Another critical feature is the security measures implemented by the app. Traders must prioritize their financial safety; hence, robust encryption protocols, two-factor authentication, and secure login options are indispensable. When a trading app demonstrates a strong commitment to protecting user data, traders can engage in transactions with peace of mind.

The range of trading options provided is also significant. A comprehensive trading app should cater to various asset classes, including stocks, options, forex, and cryptocurrencies. This diversity not only allows traders to diversify their portfolios but also presents them with numerous investment opportunities to capitalize on market movements.

Moreover, research tools are essential for informed decision-making and effective trading strategies. A quality trading app should offer access to market analysis, real-time data, and various charting tools. This feature can greatly enhance a trader’s ability to perform technical analysis and develop informed trading plans.

Finally, customer support plays a pivotal role in a trader’s experience. Having access to responsive and knowledgeable support can help resolve issues quickly, ensuring that traders can maintain their focus on the markets. Whether through live chat, email support, or telephone options, accessible customer service is fundamental for fostering a trustworthy trading environment.

Top Trading Apps Reviewed

The landscape of trading apps has evolved significantly, offering an array of options for investors looking to manage their portfolios on the go. This section will delve into several leading trading platforms, examining key features, usability, commission fees, and user reviews to provide a comprehensive understanding of each app’s strengths and weaknesses.

First, Robinhood has garnered attention for its commission-free trading model, appealing to new investors eager to dive into the market without incurring additional costs. The app’s user interface is streamlined and user-friendly, making it accessible for beginners. However, some users express concerns regarding its customer service and limited investment options in terms of portfolio diversity.

Another strong contender in the trading app arena is ETRADE, which offers a robust suite of features including research tools, educational resources, and access to various investment products. ETRADE’s mobile application is well-rated for its functionality and design, though it does charge commissions on certain trades, which may deter cost-conscious investors.

TD Ameritrade stands out for its comprehensive trading platform, especially with its thinkorswim app that caters to more advanced traders. The app supports a wide range of analysis tools and investment options, providing users with the resources they need to make informed decisions. However, like ETRADE, TD Ameritrade’s commission fees can vary depending on the type of trade executed.

Finally, platforms like Webull and Fidelity are also worth mentioning. Webull offers commission-free trading with a strong focus on providing analytical tools, while Fidelity is known for its extensive research capabilities and customer service. Each app has unique features that may appeal to different investor preferences, making it essential to assess individual needs when choosing a trading app.

Tips for Successful Trading with Apps

Successful trading using mobile applications requires a strategic approach that encompasses various key elements. First and foremost, setting clear trading goals is paramount. Traders should establish short-term and long-term objectives, which will help guide their decision-making process and maintain focus amidst market fluctuations. By documenting these goals, users can continually assess their progress, identify areas for improvement, and adjust strategies as needed.

Understanding market trends is another critical factor in trading success. Mobile trading apps typically offer real-time data and analytics, enabling traders to monitor price movements and market sentiment. It is essential to use this data effectively, recognizing patterns that may indicate potential opportunities or risks. Staying informed about relevant news events and economic indicators can also provide valuable context to understand market trends better and make informed trading choices.

Risk management is a crucial aspect of trading that cannot be overstated. Traders should determine their risk tolerance and utilize appropriate measures, such as stop-loss orders, to safeguard their investments. Assessing potential rewards against the risks taken ensures that traders do not overexpose themselves to market volatility. Additionally, traders should avoid the common pitfall of emotional trading, which may arise from fear or greed. Maintaining a disciplined approach and adhering to a well-defined trading plan can help mitigate the temptation to make impulsive decisions.

Continuous learning is vital in a dynamic trading environment. Engaging with online resources, participating in webinars, and joining trading communities can enhance understanding and provide new strategies. By staying updated on trading trends, tools, and techniques, traders can adapt to market changes and refine their approaches, ultimately leading to improved results. Therefore, maintaining a mindset of lifelong learning will contribute significantly to a successful trading experience through mobile apps.